Sim Tricker Online: What It Is, How to Protect Yourself,

The phrase sim tricker online refers to online scams and attacks that use mobile SIMs as an entry point to steal accounts, money, or personal data. This guide explains the threat in plain language and gives practical, safe advice to help you prevent and recover from these attacks.

What does “sim tricker online” mean?

The keyword sim tricker online is often used by people searching for information about scams that involve mobile phone SIM cards. Attackers try to take control of a victim’s phone number to intercept text messages, calls, and two-factor authentication (2FA) codes. Once they control the number, they may attempt to access email, banking, social media, or cryptocurrency accounts.

Important: This article explains the nature of these scams and how to defend against them. It does not provide instructions for committing wrongdoing.

How attackers typically exploit SIMs (high level)

Attackers use many approaches to target mobile numbers. At a high level, those approaches fall into two categories:

- Social engineering — tricking customer support agents or using phishing to get a carrier to transfer a number to a new SIM.

- Account takeover — using leaked personal data to reset passwords that rely on SMS codes, or leveraging weak recovery options at services that use phone numbers for verification.

We intentionally avoid step-by-step details for those techniques because sharing how to carry out an attack is harmful and illegal.

Signs you may be a victim of sim tricker online attacks

Watch for these red flags. Early detection helps limit damage.

- Your phone suddenly has no signal even though you are in coverage. This can indicate your number was moved to another SIM.

- You stop receiving SMS messages or authentication codes you normally get.

- You get unexpected password reset emails or login alerts for accounts you did not request.

- Unexpected calls from your mobile provider asking to confirm changes you didn’t request, or messages about SIM activation.

Practical prevention tips

Use the following measures to reduce risk. These are safe, legitimate defenses that anyone can apply.

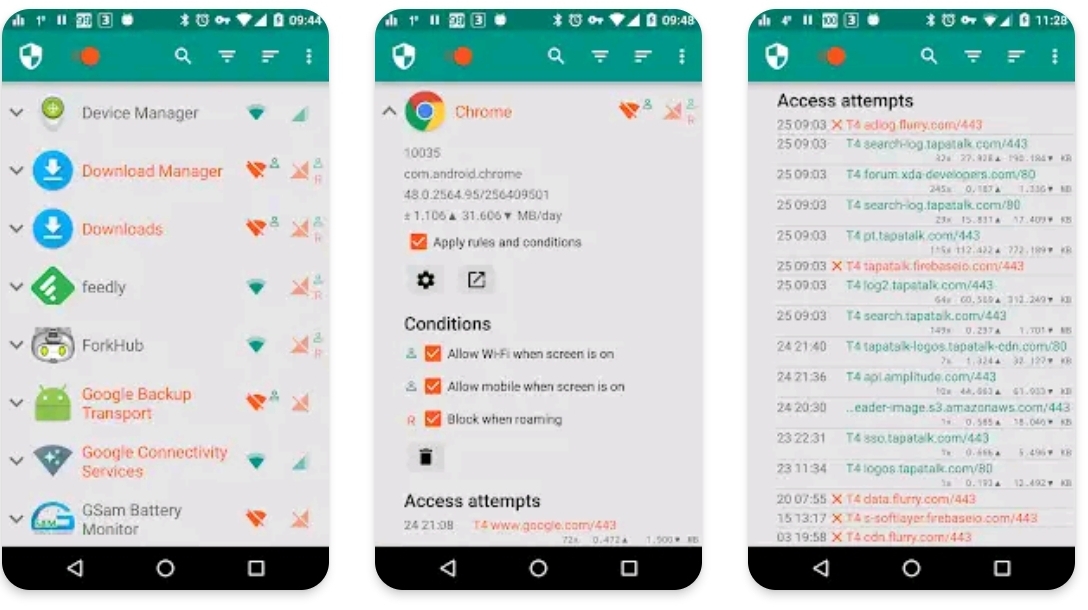

- Avoid relying solely on SMS for important accounts. Where possible, use app-based authenticators (for example, authenticator apps) or hardware security keys. These methods are not tied to your phone number and are much harder to hijack.

- Lock your mobile account with a PIN or passcode. Contact your mobile provider and enable any extra security features they offer for account changes. Ask for a port freeze or an account security PIN if available.

- Be cautious with personal data online. Limit public sharing of information that could be used to impersonate you to service agents. Attackers use leaked or scraped data to convince phone company employees to authorize transfers.

- Enable multi-factor authentication that uses apps or keys. Where a service offers both SMS and app-based 2FA, choose the app or physical key option.

- Monitor accounts and enable alerts. Turn on login alerts and review recent activity regularly so you can act fast if something looks off.

- Use strong, unique passwords and a password manager. If attackers obtain a password elsewhere, unique passwords prevent a chain reaction of account takeovers.

- Learn to spot phishing. Never give credentials or verification codes to unknown callers, and avoid clicking links in suspicious messages.

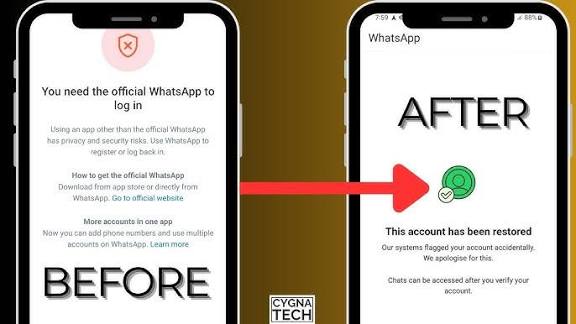

What to do immediately if you suspect a “sim tricker online” incident

If you see signs of SIM compromise, act quickly. The faster you respond, the better your chances of limiting loss.

- Contact your mobile provider right away. Ask them to block porting or reactivation and to place a security hold on your account. Use official support channels listed on your provider’s website.

- Change passwords for your most sensitive accounts, starting with email and banking. Do this using a device and network you trust, not the compromised phone number.

- Switch 2FA away from SMS to an authenticator app or hardware key on services that offer that option.

- Notify banks and financial services and ask them to monitor or freeze suspicious transactions, if needed.

- Report the incident to local authorities and to consumer protection bodies when appropriate. Keep copies of logs, support reference numbers, and any suspicious messages or calls.

Recovering after a SIM incident

Recovery can take time. Expect to provide ID to your carrier, and to follow formal dispute procedures with banks or platforms. Keep detailed notes of every conversation with support teams including dates, times, and ticket numbers. If you face financial loss, escalate immediately with the bank and with law enforcement.

Legal and ethical context

SIM fraud is illegal in most countries and can lead to criminal charges. Services and regulators increasingly recognize the harm and are improving safeguards. If you are researching the term sim tricker online because you want to protect people or write awareness material, focus on prevention, detection, and legal remedies. If you are tempted to experiment with any attack technique, do not. It can cause real harm and legal consequences.

How businesses and providers are responding

Mobile providers and online services are improving defenses. Many now offer account security PINs, enhanced identity checks, and non-SMS 2FA options. Financial institutions are introducing stronger verification for high-risk changes. Users should ask providers about available protections and take advantage of them.

Useful checklist: defend against sim tricker online scams

- Use an authenticator app or hardware key for 2FA where possible.

- Set a strong password and use a password manager.

- Ask your carrier for extra account security (PIN, port freeze).

- Monitor accounts for strange activity; enable alerts.

- Do not share verification codes or account details with anyone.

- Report suspicious activity immediately and document everything.

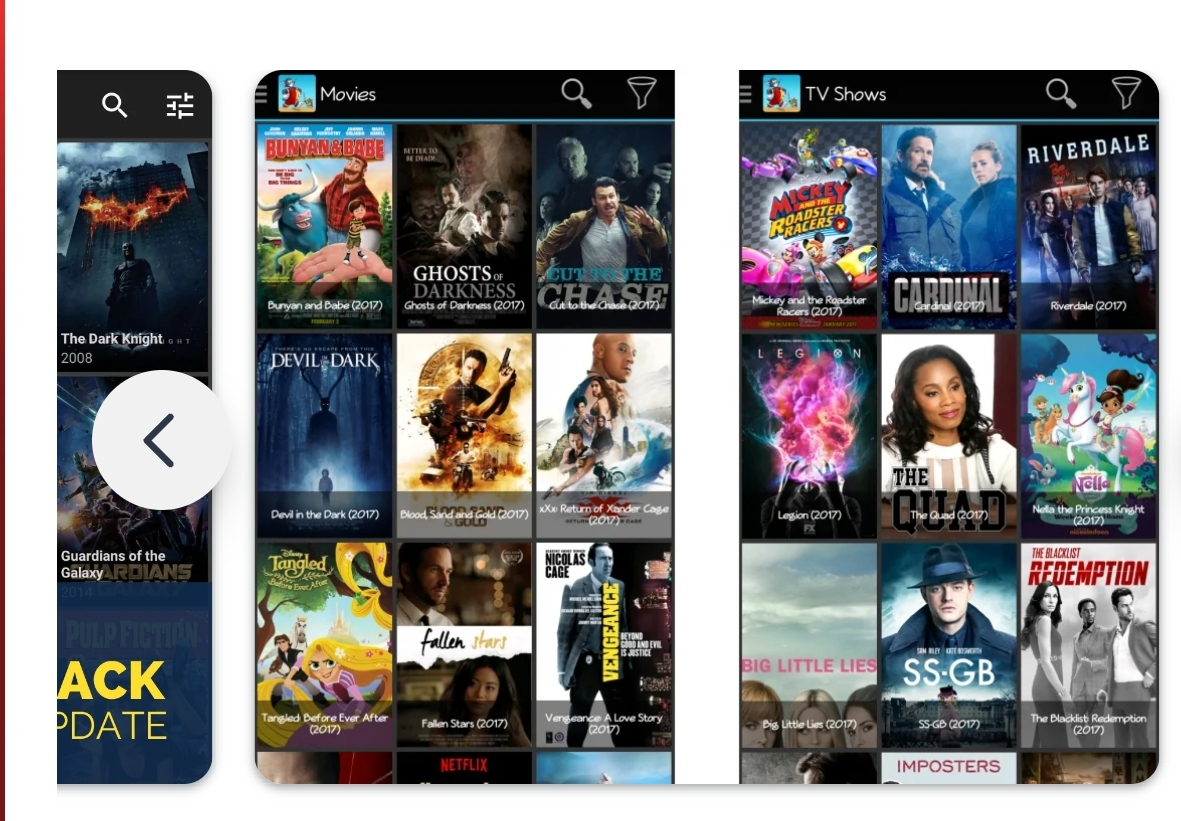

Site click hare

Conclusion

The search term sim tricker online highlights a real and growing problem: attackers who exploit mobile phone numbers to break into accounts. The good news is that simple, practical steps make you much harder to target. Move away from SMS where possible, lock down your mobile provider account, and react quickly if you spot anything suspicious. Awareness and quick action are the best defense.